pa inheritance tax exemption amount

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents. While the Pennsylvania inheritance tax can take a bite out of your estate it is rarely devastating.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

If there is no spouse or if the spouse has forfeited hisher rights.

. The surviving spouse does not pay a Pennsylvania inheritance tax. A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and. If your direct descendants or lineal heirs fall outside of the above there is a 45 tax inheritance tax in Pennsylvania.

The tax rate is. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. The federal gift tax has an exemption of 15000 per recipient per year for.

REV-714 -- Register of Wills Monthly Report. Furthermore this exemption can be taken as a deduction on line 3 of Schedule H of the Pennsylvania Inheritance Tax Return Form REV-1500. There is a federal estate tax that may apply and Pennsylvania does have an inheritance tax.

There are other federal and state tax requirements. Traditionally the Pennsylvania inheritance tax had two tax rates. The Pa tax inheritance tax rates are as follows.

What is the family exemption and how much can be claimed. REV-1197 -- Schedule AU. 45 for any asset transfers to lineal heirs or direct descendants.

To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily. In Pennsylvania for instance if a parent inherits property from a child age 21 or younger the. Pennsylvania Inheritance Tax Safe Deposit Boxes.

Amount of tax paid divided by 19 and 5 of actual tax due You cannot overpay tax to get larger discount In effect estate earns 10 on the early payment. 45 percent on transfers to direct. Ad Deductions And Credits Can Make All.

Amount of tax paid divided by 19 and 5 of actual tax due You cannot overpay tax to get. In an attachment to the tax return. Charities and the government generally are.

15 for asset transfers to other heirs. There are also certain situations that may exempt someone from inheritance tax. Other Necessary Tax Filings.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. Lineal heirs refer to heirs such as grandchildren. REV-720 -- Inheritance Tax General Information.

If you have any questions about. Attorney fees incidental to litigation instituted by the beneficiaries for their benefit do not constitute a proper deduction. The Pennsylvania inheritance tax isnt the only applicable tax for the estates of decedents.

12 for asset transfers to siblings. The Pa tax inheritance tax rates are as follows. The rates for Pennsylvania inheritance tax are as follows.

Lets say that when you die your leave your home and investments to your.

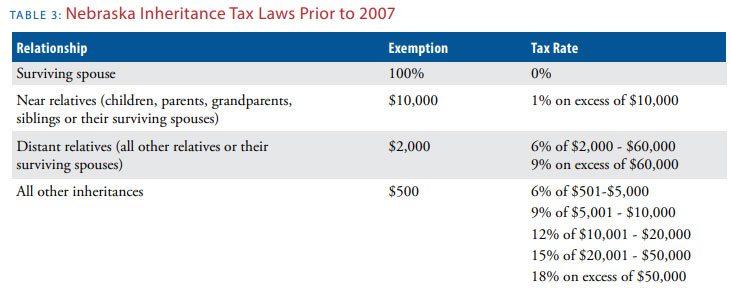

Death And Taxes Nebraska S Inheritance Tax

A Comparison Of The Pennsylvania And New Jersey Inheritance Tax Laws

How To Avoid Pennsylvania Inheritance Tax Bononi And Company Pc

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Do Heirs Pay Inheritance Tax On Iras In Pennsylvania

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

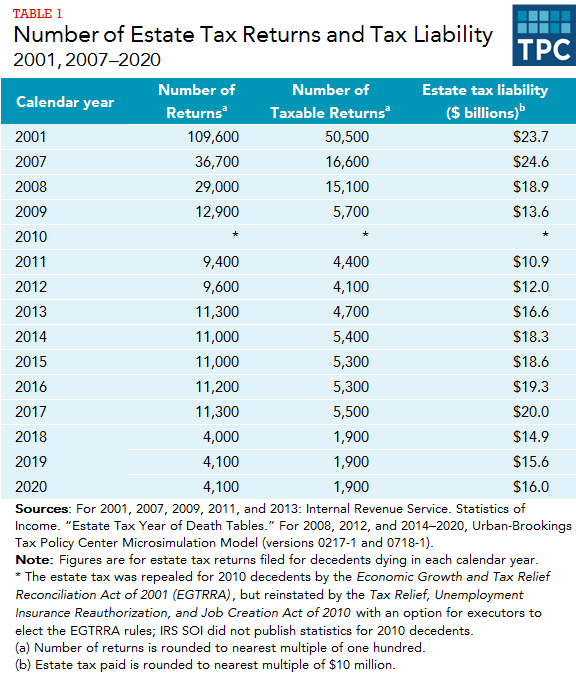

How Many People Pay The Estate Tax Tax Policy Center

Taxes And Property Taxes Proposition 13 60 90 58 193 And Proposition 19 Lucas Real Estate

Death And Taxes Part Ii State Taxes On Pasture

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Federal Gift Tax Vs California Inheritance Tax

Exploring The Estate Tax Part 1 Journal Of Accountancy

Update Minnesota Estate Tax Exemption Fafinski Mark Johnson P A

61 Pa Code Chapter 31 Imposition

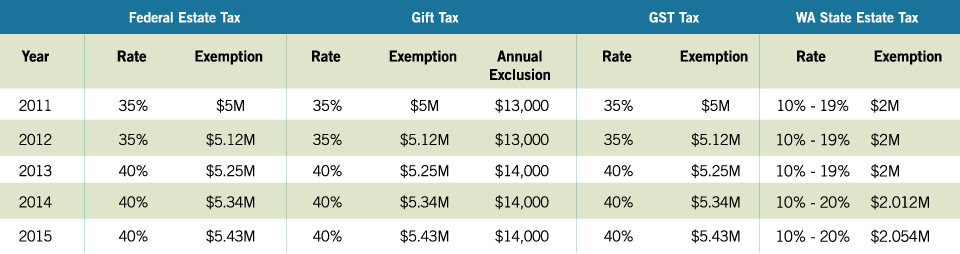

2015 Estate Planning Update Helsell Fetterman

Inheritance Tax Here S Who Pays And In Which States Bankrate

The Increased Federal Estate Tax Exemption Doesn T Decrease The Need For Wills And Estate Plans Mcandrews Law Firm

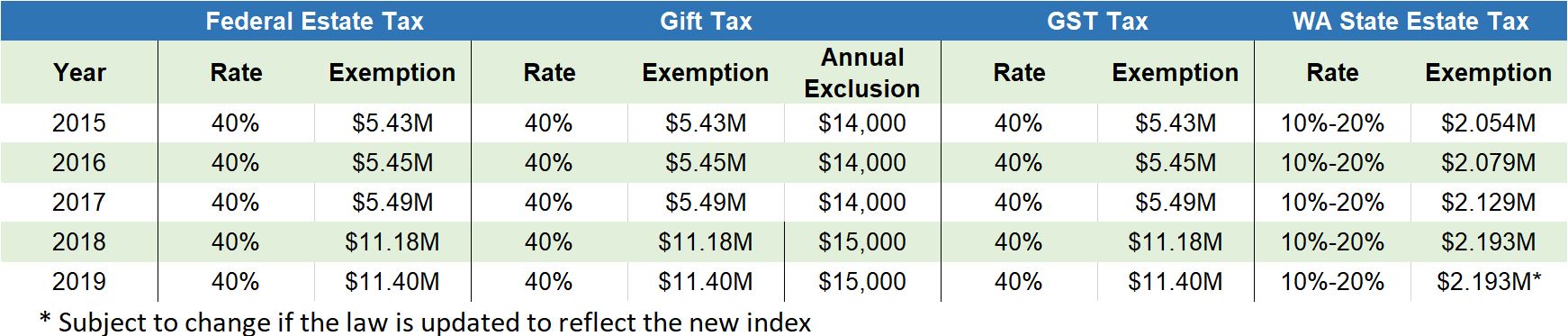

2019 Estate Planning Update Helsell Fetterman

Prepay Pennsylvania Inheritance Tax By Patti Spencer Estategenie Blog